You are here:iutback shop > price

MicroStrategy Bitcoin Purchase Price: A Deep Dive into the Company's Cryptocurrency Investment Strategy

iutback shop2024-09-20 23:21:11【price】5people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, the cryptocurrency market has witnessed a significant surge in interest and investm airdrop,dex,cex,markets,trade value chart,buy,In recent years, the cryptocurrency market has witnessed a significant surge in interest and investm

In recent years, the cryptocurrency market has witnessed a significant surge in interest and investment. Among the numerous companies that have ventured into the world of digital currencies, MicroStrategy stands out as a pioneer in embracing Bitcoin as a primary asset in its balance sheet. This article delves into the MicroStrategy Bitcoin purchase price, analyzing the company's investment strategy and its implications for the cryptocurrency market.

MicroStrategy, a leading provider of business intelligence software, has been a vocal advocate for Bitcoin. The company's CEO, Michael Saylor, has been a strong proponent of the cryptocurrency, emphasizing its potential as a hedge against inflation and a store of value. In May 2020, MicroStrategy made a historic decision to allocate a substantial portion of its cash reserves to purchase Bitcoin, marking the beginning of a new era for the company.

The MicroStrategy Bitcoin purchase price has been a topic of much discussion and analysis. Initially, the company acquired Bitcoin at an average price of around $11,000 per coin. As the cryptocurrency market experienced a bull run, MicroStrategy continued to accumulate Bitcoin, increasing its holdings to over 70,000 coins. The average purchase price for these coins has since risen to approximately $27,000.

The MicroStrategy Bitcoin purchase price has been a critical factor in the company's investment strategy. By acquiring Bitcoin at varying prices, MicroStrategy has managed to diversify its risk and capitalize on the volatility of the cryptocurrency market. The company's decision to hold onto its Bitcoin rather than selling it at higher prices has been a subject of debate among investors and analysts.

Proponents of MicroStrategy's Bitcoin purchase price strategy argue that the company is taking a long-term view of the cryptocurrency market. By holding onto Bitcoin, MicroStrategy is positioning itself to benefit from the potential growth of the digital currency. Additionally, the company's investment in Bitcoin has helped to diversify its revenue streams, reducing its reliance on traditional software sales.

On the other hand, critics of MicroStrategy's Bitcoin purchase price strategy point out the risks associated with holding a significant portion of a company's assets in a highly volatile asset. They argue that the company's decision to invest heavily in Bitcoin could lead to significant losses if the cryptocurrency market were to experience a downturn.

Despite the criticism, MicroStrategy's Bitcoin purchase price strategy has been successful thus far. The company's investment in Bitcoin has generated substantial returns, with the value of its Bitcoin holdings increasing significantly. This has not only bolstered the company's financial position but has also positioned it as a leader in the cryptocurrency space.

The MicroStrategy Bitcoin purchase price has also had a ripple effect on the broader cryptocurrency market. The company's decision to invest in Bitcoin has inspired other businesses to explore the potential of digital currencies. This has led to increased interest in the cryptocurrency market, driving up demand and prices for various digital assets.

In conclusion, the MicroStrategy Bitcoin purchase price has been a crucial component of the company's investment strategy. By acquiring Bitcoin at varying prices, MicroStrategy has managed to diversify its risk and capitalize on the potential growth of the cryptocurrency market. While the strategy has faced criticism, the company's success thus far suggests that Bitcoin may indeed be a valuable asset for businesses looking to diversify their investment portfolios. As the cryptocurrency market continues to evolve, it will be interesting to see how MicroStrategy's Bitcoin purchase price strategy unfolds and what impact it will have on the company and the broader market.

This article address:https://www.iutback.com/btc/86a24799666.html

Like!(1185)

Related Posts

- Unlocking the Potential of Bitcoin Mining: A Deep Dive into the Mining Bitcoin Calculator

- Why Buy and Sell Prices Differ in Bitcoin

- How to Transfer Coins from Binance to Ledger Nano X

- Can You Earn Bitcoin for Free?

- Bitcoin Last Month Price in INR: A Comprehensive Analysis

- Can We Send Bitcoin Wallet to Any Bovada Account?

- Cash App Bitcoin Growth: A Game-Changer in the Cryptocurrency Market

- Binance, the leading cryptocurrency exchange platform, has once again made headlines with the listing of Zilliqa (ZIL) against Tether (USDT) under the trading pair ZIL/USDT. This addition to Binance's vast list of trading pairs is a significant development for both the Zilliqa community and the broader cryptocurrency market.

- Bitcoin Armory Wallet: A Comprehensive Guide to Secure Cryptocurrency Management

- Unit Wallet Bitcoin: The Ultimate Cryptocurrency Solution

Popular

Recent

Bitcoin Wallet Cracker: A Deep Dive into the World of Cryptocurrency Security Breaches

Gift Card Binance Buy: A Convenient and Secure Way to Invest in Cryptocurrency

How to Connect Metamask Wallet to Binance Smart Chain

**Unlocking the Potential of Bitcoin Address Mining Pool Hub

Bitcoin Mystery Wallet: Unraveling the Enigma of Digital Currency

The Number of Bitcoin Cash: A Comprehensive Analysis

Running Bitcoin Mining Software: A Comprehensive Guide for Beginners

Binance Smart Chain Metamask iOS: A Comprehensive Guide to Seamless Blockchain Interactions

links

- Binance App Developer: A Game-Changer in the Cryptocurrency World

- Bitcoin HD Mining Pools: The Future of Cryptocurrency Mining

- **Bitcoin Mining Partnership: A New Era of Collaboration in Cryptocurrency

- Binance App iPhone Reddit: A Comprehensive Review

- Understanding the Binance USDC Withdrawal Fee: What You Need to Know

- What Determine the Price of Bitcoin?

- Best Free Bitcoin Wallet 2018: Your Ultimate Guide to Securely Storing Cryptocurrency

- The Rise of Steel Wallet Bitcoin: A Secure and Durable Solution for Cryptocurrency Storage

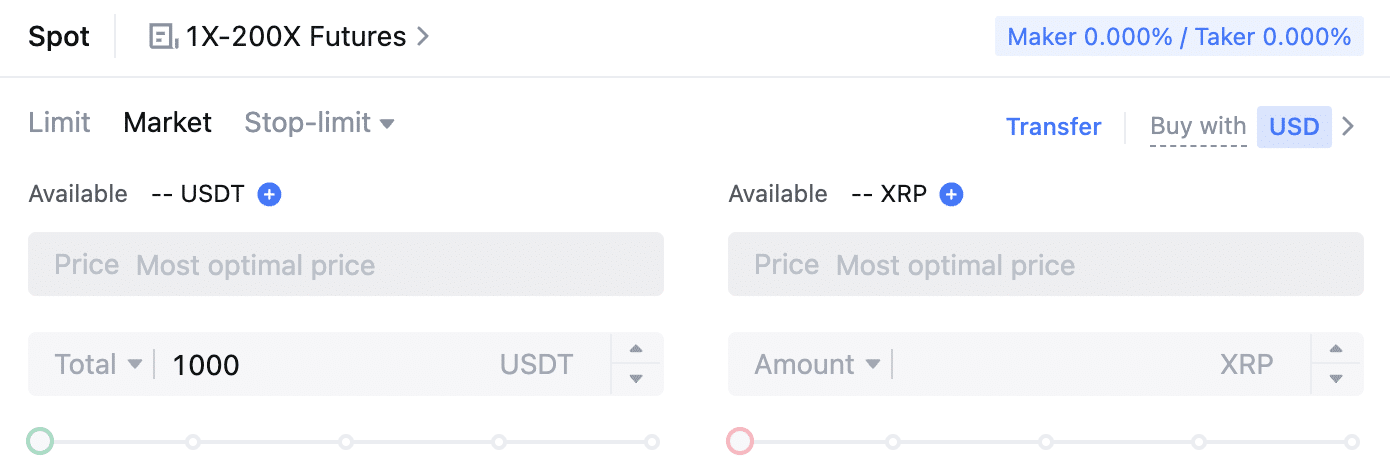

- Binance US Spot Trading: A Comprehensive Guide to the Platform

- Bitcoin Mining Energy Problem: A Growing Concern